Orange situation is 2024

Mar 07, 2024

The orange market for the year 2024 makes it necessary to look for alternatives to offer the best possible product […]

+ View more

Mar 07, 2024

The orange market for the year 2024 makes it necessary to look for alternatives to offer the best possible product […]

+ View more

Oct 26, 2023

In recent times, the apple juice industry has experienced significant shifts in pricing due to lower production and heightened global […]

+ View more

Aug 04, 2023

There is a growing mentality amongst consumers that added sugar in drinks, and in food in general, is detrimental to […]

+ View more

May 11, 2023

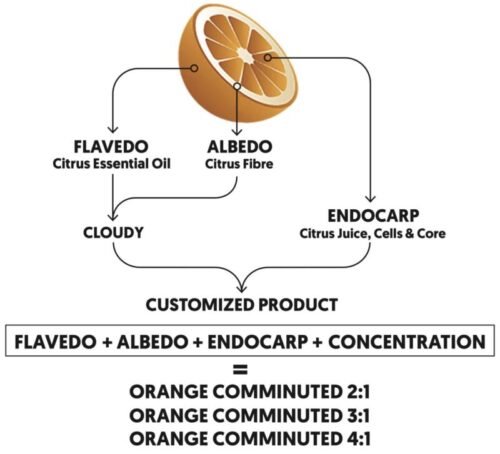

Comminuted products are positioned as a perfect solution in the food and beverage industry thanks to the complete use of […]

+ View more

Apr 03, 2023

The market for citrus fruits continues to increase with respect to the year 2022. In this year, Brazil, China and […]

+ View more

May 11, 2022

Citrus concentrates are a safe asset. Orange is undoubtedly the preferred flavour among consumers worldwide. Well above other flavours like […]

+ View more

Apr 01, 2022

Lemonconcentrate specializes in orange, clementine and lemon products. Among our wares related to lemon fruit you will find essential oils, […]

+ View more

Mar 11, 2022

More often is the Yuzu fruit considered a cross breed between a Mandarin Orange, grapefruit and lime mainly because it […]

+ View more

Feb 20, 2022

There is a growing mentality amongst consumers that added sugar in drinks, and in food in general, is detrimental to […]

+ View more

Jan 28, 2022

At Lemonconcentrate we are specialized in citric products, both lemon and orange, thank to the perfect situation of our […]

+ View more

Dec 13, 2021

Unless you’ve been living under a rock (or maybe a palm tree!) for the past year, you can’t have escaped […]

+ View more

Oct 13, 2021

Some of grapes history Grapes have changed the world. As one of the oldest edible plants, archaeological evidence suggests grapes […]

+ View more

Oct 04, 2021

Most of the juices in our market are reconstituted from juice concentrate. The generalized belief that concentrated juice […]

+ View more

Jan 24, 2021

Unless you’ve been living under a rock (or maybe a palm tree!) for the past year, you can’t have escaped […]

+ View more

May 02, 2019

There is no denying that the current whole food movement is encouraging people to increase their consumption of vegetables […]

+ View more

Apr 17, 2019

Consumers of dairy milky products in search of a healthy lifestyle have greatly increased. This has forced the dairy […]

+ View more

Feb 19, 2019

Energy Products The concept of eating or drinking certain products to provide an energy boost has been popular for some […]

+ View more

Feb 13, 2019

Dairy products have been the primary source of calcium, proteins, vitamin A and D for years, essential for the growth […]

+ View more

Feb 05, 2019

Aloe Vera juice is a popular health drink that is catching up in various countries across the world. The health […]

+ View more

Jan 15, 2019

The beautiful shiny red jewel-like seeds of the pomegranate fruit (Punica granatum) are as beneficial as they are visually appealing. […]

+ View more

Jan 14, 2019

In our era, coconut has become the new ingredient for better health. In recent times, the buzz around coconut has […]

+ View more

Jan 14, 2019

The natural beauty industry is taking root quite fast with people preferring and going for products made from native seeds […]

+ View more

Dec 20, 2018

Tea is one of the most classic beverages we have around. With different communities brewing their tea differently, each one […]

+ View more

Dec 20, 2018

High Pressure Processing (HPP) is very successful and innovative new technology used by the food industry that maintains the ingredients […]

+ View more

Jul 04, 2018

The awards ceremony of The Superior Taste Awards 2018 took place on the 11th of June in Brussels. The Superior Taste Awards, also known as […]

+ View more

Dec 11, 2017

A sweet mix of numerous sugars (including glucose, sucrose and fructose), honey is also well known to have antibacterial properties. […]

+ View more

Dec 11, 2017

All roads lead to Cologne in October 2017. It will be home to Anuga 2017, the world’s largest food and […]

+ View more

Dec 11, 2017

The forecast for the orange price is bullish in the USA; in fact, futures traders say that speculators have been […]

+ View more

Dec 11, 2017

At Lemon Concentrate we try to innovate as much as possible to satisfy our clients needs. We have an […]

+ View more

Dec 11, 2017

The pomegranate juice concentrate is our last creation and has been elaborated with a new method developed during the last […]

+ View more

Dec 11, 2017

At LemonConcentrate we try to regularly increase our portfolio in order to satisfy all the needs of our clients. We […]

+ View more

Dec 11, 2017

We are one of the biggest lemon concentrate suppliers. We harvest and process fresh lemons from which we then supply beverage […]

+ View more

Dec 11, 2017

The freshness and quality of a good lemon puree is related to the closeness between the lemon puree treatment and […]

+ View more

Dec 11, 2017

LEMON CONCENTRATE has been developed new solutions on concentrate market for lemon concentrate juice above lemon fruit concentrate. This new […]

+ View more

Dec 11, 2017

Our orange puree (orange comminuted) gives freshness, taste and body to fruit beverages and marmalades. This fruit puree is made […]

+ View more

Dec 11, 2017

Strawberry concentrate is a healthy product, rich in vitamins and antioxidants. The intense red colour and fresh aroma of the […]

+ View more

Dec 11, 2017

Our asparagus puree is made with the highest quality asparagus. All manufacturers agree that this vegetable is one of the […]

+ View more

Dec 11, 2017

The main forecasts aren’t good for the orange juice production this season. The USDA (United States Department of Agriculture) has […]

+ View more

Dec 11, 2017

The natural market reaction to the bad orange season data was bullish. Industry sources in the US say the lower […]

+ View more

Dec 11, 2017

There is some uncertainty about pineapple pricing due to the low production of Thailand, the main pineapple supplier. Processing plants […]

+ View more

Dec 11, 2017

The process to obtain apple concentrate is actually simple: it is obtained by removing water from apple fruit. However, when […]

+ View more

Dec 11, 2017

In spite of the fact that orange production in the US is expected to be higher than previous forecast, it […]

+ View more

Dec 11, 2017

The forecast for the orange juice production in Brazil is a 18% lower than last season. Consequently, the Brazilian company […]

+ View more